Timor Invest https://ift.tt/2sqIX2q

Author’s Note: This article was updated on December 27th, 2019. When I first published this article in February, I wrote that Panasonic Corp.’s (Tokyo: 6752) stock was down 38% in the past year. It went on to bottom in August 2019. Now it’s trading around where it was when I first wrote about it. As I illustrate in the article below, Panasonic is a great play for 2020 and beyond!

Story Highlights

- Tesla grabs headlines thanks to CEO Elon Musk and its flashy electric vehicles (EVs).

- But a household name is secretly powering its fleet of cars.

- Anthony Planas shares the No. 1 company every EV bull needs to own.

Tucked away in the middle of the desert is one of the most advanced factories in the world. Known as the Gigafactory 1, it is Tesla’s crown jewel.

The massive facility can fit 93 Boeing 747 jets in its footprint. Tesla doesn’t build cars here. It builds key parts of the cars.

Namely the battery packs.

While Tesla soaks in the glory from the Gigafactory’s fame, there is a Japanese company churning out the battery packs.

A Bright Future for Electric Cars

Of the 1 billion cars on the road today, fewer than 5 million are electric vehicles (EVs). But EVs are set to take over the world.

The International Energy Agency (IEA) forecasts that by 2030, between 125 million and 220 million EVs will be on the roads.

The demand for EVs came from higher energy costs and concerns over global warming. Carmakers have poured billions of dollars into designing electric models.

Even with lower energy costs today, there is too much momentum to stop the shift to electric cars.

Tesla is a leader in the EV race. The Silicon Valley automaker transformed from a boutique electric carmaker in 2003 to a full-blown automaker today.

Tesla has faced a number of challenges in its rapid growth. Production delays, funding concerns and controversies surrounding its CEO, Elon Musk, have made it a bumpy ride for investors.

But there is an amazing opportunity sitting in plain sight for investors who want an even bigger piece of the EV story than Tesla can offer.

Panasonic Is Making a Quiet Shift

Panasonic is best known for home electronics like TVs and DVD players.

But the Japanese company’s fastest-growing segment isn’t in our homes. It’s in our cars.

It makes many of the batteries and sensors for our cars and trucks.

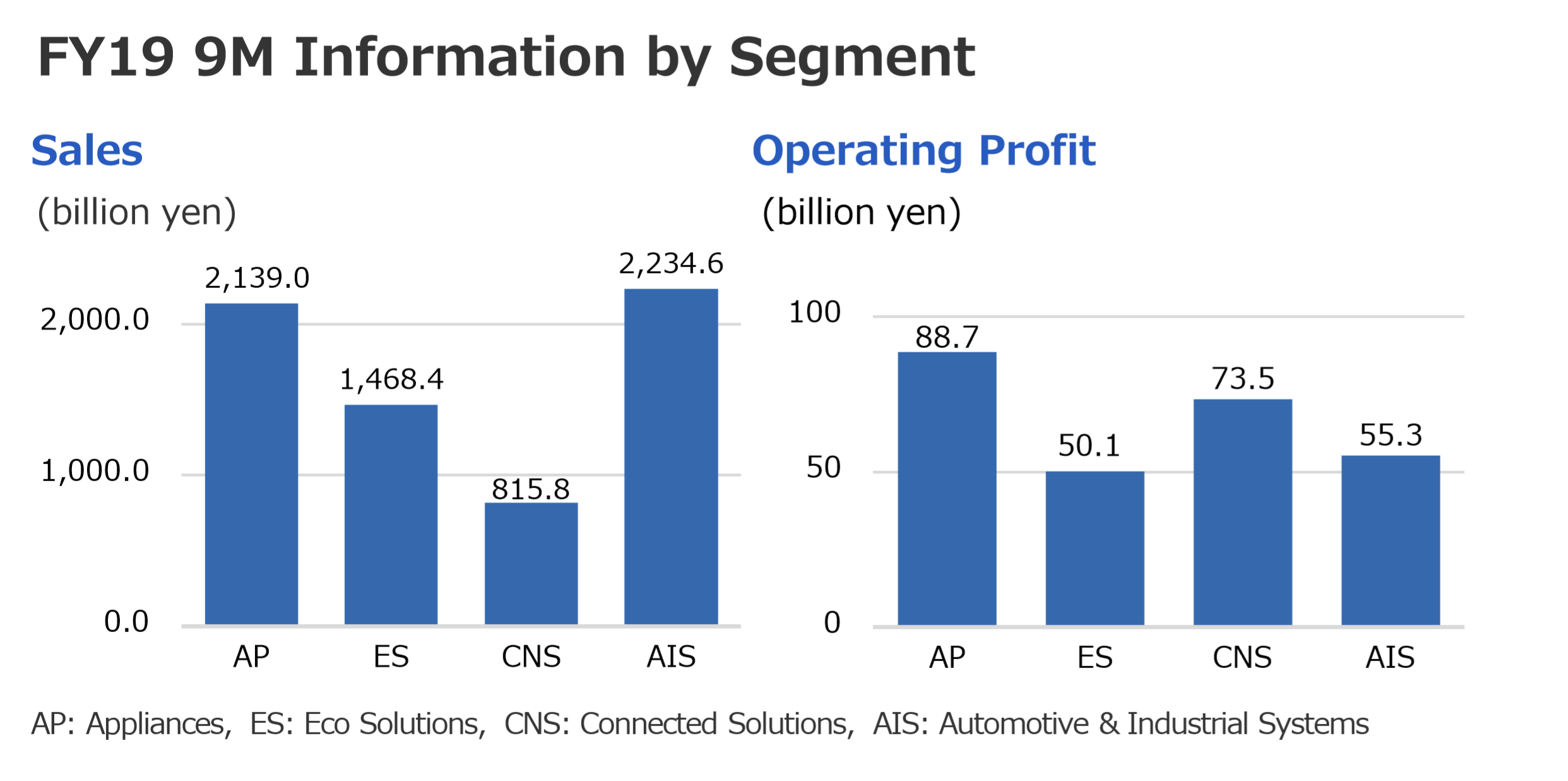

Known as Automotive & Industrial Systems (AIS) in filings, this segment is its biggest revenue driver.

Source: Panasonic Investor Relations

While Tesla may take all the credit for the Gigafactory, Panasonic makes its batteries.

But one month ago, Panasonic inked a deal with Toyota that will dwarf its operation in the Gigafactory.

The two companies are forming a joint venture (JV) to develop and produce EV batteries.

Toyota was an early adopter of electric tech with the release of the Prius hybrid in 1997.

This partnership reaffirms its commitment to electric cars. The JV will help Toyota achieve its goal of selling 5.5 million EVs.

In contrast, Tesla has sold fewer than 400,000 cars in seven years.

Invest Now for Long-Term Gains

The connection with Toyota goes beyond the brand.

Toyota’s partnerships with other major automakers, including Subaru and BMW, will see these batteries powering other brands’ push to go electric.

But Panasonic’s share price doesn’t reflect the growth this JV offers. The share price is down 38% in the past year.

That’s due to fear of slowing growth in Japan and Asia. While Panasonic’s sales slowed, they are still above 2016 levels when shares were at a similar price as today.

Panasonic’s transformation into a global provider of batteries for EVs won’t happen overnight. It could face further headwinds from trade disputes and a slowdown in economic growth.

But for investors thinking long term, this is an excellent buy.

Panasonic Corp. (Tokyo: 6752) is not traded on the major American exchanges. Investors can use brokers with international services to buy on the Tokyo exchange. It is also available over-the-counter with the ticker PCRFY.

Good investing,

Anthony Planas

Internal Analyst, Banyan Hill Publishing

This article was published on February 27th, 2019 updated on December 27th, 2019.

Комментариев нет:

Отправить комментарий